Rents Fell Again. Here’s What the Data Actually Says

Jan 15, 2026

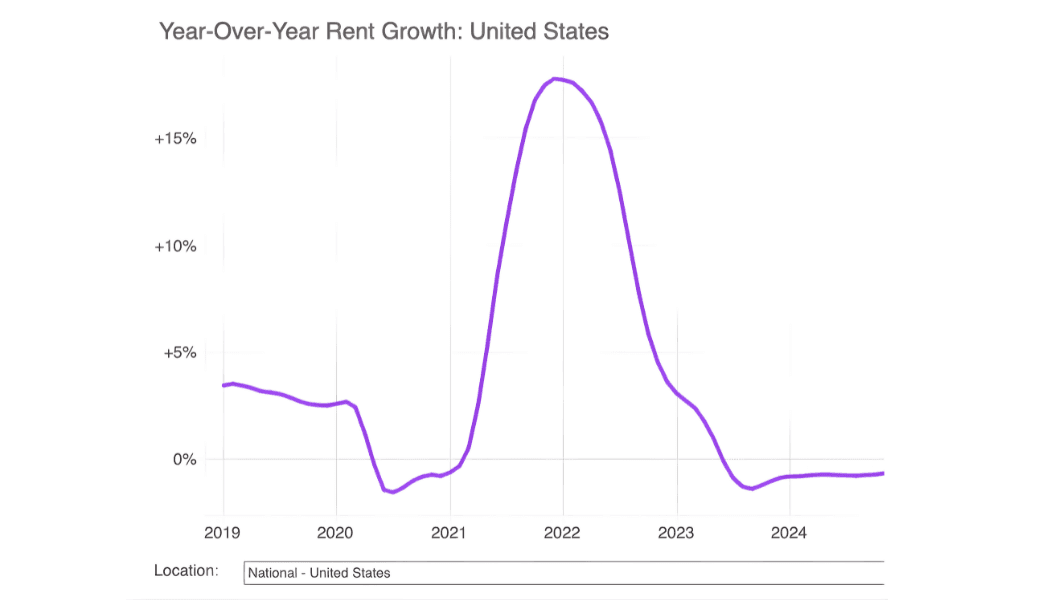

December marked another step down in national rents. Apartment List reports the national median rent fell 0.8% in December to $1,356, and is down 1.3% year over year. It also puts the national median 5.9% below the 2022 peak.

This is not a crash. But it is a clear signal: pricing power is soft, and it’s staying soft longer than many operators expected. If you own at scale, the temptation is to shrug and call it “seasonal.” Sure, winter is softer. But this looks like more than a normal holiday lull.

The bigger issue is leasing speed

Apartment List’s data suggests the market is giving renters more time and more options:

Vacancy index: 7.3%, the highest level in their index history (since 2017).

Time on market: average 39 days to lease, a record high back to at least 2019.

When lease-up stretches, even small execution gaps turn into real money. One extra week of vacancy across a large portfolio is not “seasonality.” It’s lost NOI.

Not all markets are moving the same way

The softness is most obvious across a number of Sun Belt metros, while some Northeast and Midwest markets still show positive annual growth. Apartment List highlights examples like Austin down 6.6% YoY versus Providence up 5.6% YoY.

So the right read is not “rents are down everywhere.” It’s “the easy leasing environment is gone in many places.”

What this means for big owners

A softer rent tape usually forces three practical changes.

1) You manage to “days vacant,” not just asking rent

If your average time-to-lease is pushing ~40 days, pricing changes alone won’t fix it. You need a tighter feedback loop:

track days vacant by asset and unit type

track conversion from lead → tour → application

decide whether concessions or price cuts are actually moving leases faster

2) Response time becomes a portfolio-level metric

In a slower market, prospects shop longer and ghost more. Operators who reply in minutes tend to win more tours than teams replying hours later. Even modest improvements can matter at scale.

3) Renewals and collections matter more when growth slows

When acquisitions and rent growth are not doing the heavy lifting, retention and cash discipline do:

earlier renewal outreach

fewer unresolved service issues that drive move-outs

consistent delinquency follow-up and documentation

Some operators use tools like Domos to avoid missed calls and keep communications consistent after-hours, but the bigger point is operational discipline.

Bottom line

The December data points to a market with slightly declining rents, higher vacancy, and slower leasing. That combination doesn’t usually reward optimism. It rewards execution.

This rent slide is not a reason to panic. It is a reason to get serious.

The market is telling you that leasing is taking longer and competition is higher. The operators who win in that setup do not “wait for spring.” They tighten the workflow, measure what matters, and stop letting response time and follow-up quality be a guessing game.

Want to benchmark your leasing speed vs the market?