State of the Housing Market: What Property Operators Should Prepare For in 2026

Dec 29, 2025

There are plenty of opinions about where the housing market is going, but most of them won’t help operators run a tighter portfolio in 2026. What matters is the data shaping demand, plus the operational reality that 2025 exposed: supply didn’t “fade out” on schedule, concessions became a default lever in many markets, and staffing pressure didn’t ease. 2026 won’t reward hype. It will reward operators who run clean processes and keep residents retained.

The traditional renter cycle is breaking. People are renting longer, delaying homeownership, and expecting a level of organization and responsiveness that simply was not required years ago. Operators who understand the forces behind these shifts will be the ones who adjust early and gain an edge.

Here is what the data shows and why it matters.

First time buyers are aging and thinning out

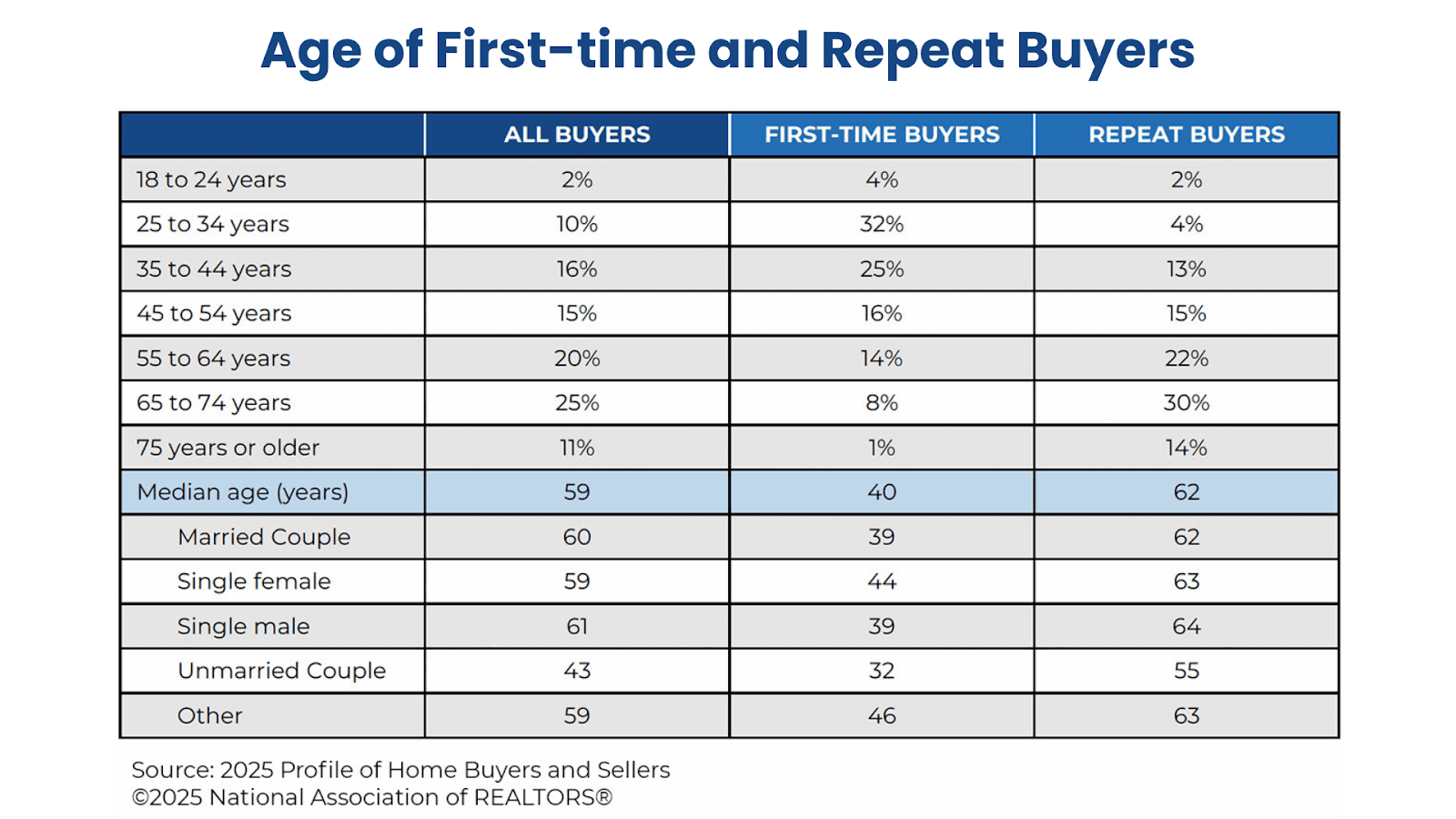

The National Association of Realtors’s Profile of Home Buyers and Sellers confirms that the median first time buyer is now 40 years old. That’s the oldest in the history of the report. It also shows that first time buyers account for only 21% of transactions, a dramatic drop from the historical norm where they made up about a third of purchases.

The trend is tied to a simple reality. Affordability has slipped and inventory remains tight. Harvard’s Joint Center for Housing Studies notes that home prices are now more than five times median household income on average, compared with roughly three and a half times income in the 1980s and 1990s. That gap pushes more households into long term renting whether they planned for it or not.

For operators, this means a larger, older, and more stable group of renters who expect professionalism and consistency, rather than a "starter apartment" experience. As a result, the focus shifts the core metric from move ins to retention. When renters are staying longer, service consistency becomes the product.

Affordability remains the defining pressure

The National Association of Home Builders tracks affordability through its Housing Opportunity Index. The latest figures show that only 37% to 40% of U.S. households can afford a median priced home. That is less than half the affordability seen during the early 2010s.

Even if rates ease, the combination of high prices and tight inventory will continue to lock millions of households out of homeownership. Renting is not a lifestyle choice for most of these families. It is the only option available in a market where math no longer works.

For operators, this confirms what many have seen on the ground. Today’s renter stays longer, plans differently, and engages more like a long term customer than a short term occupant. And long term renters demand a clear, predictable, transparent operational experience.

Housing supply is still far behind demand

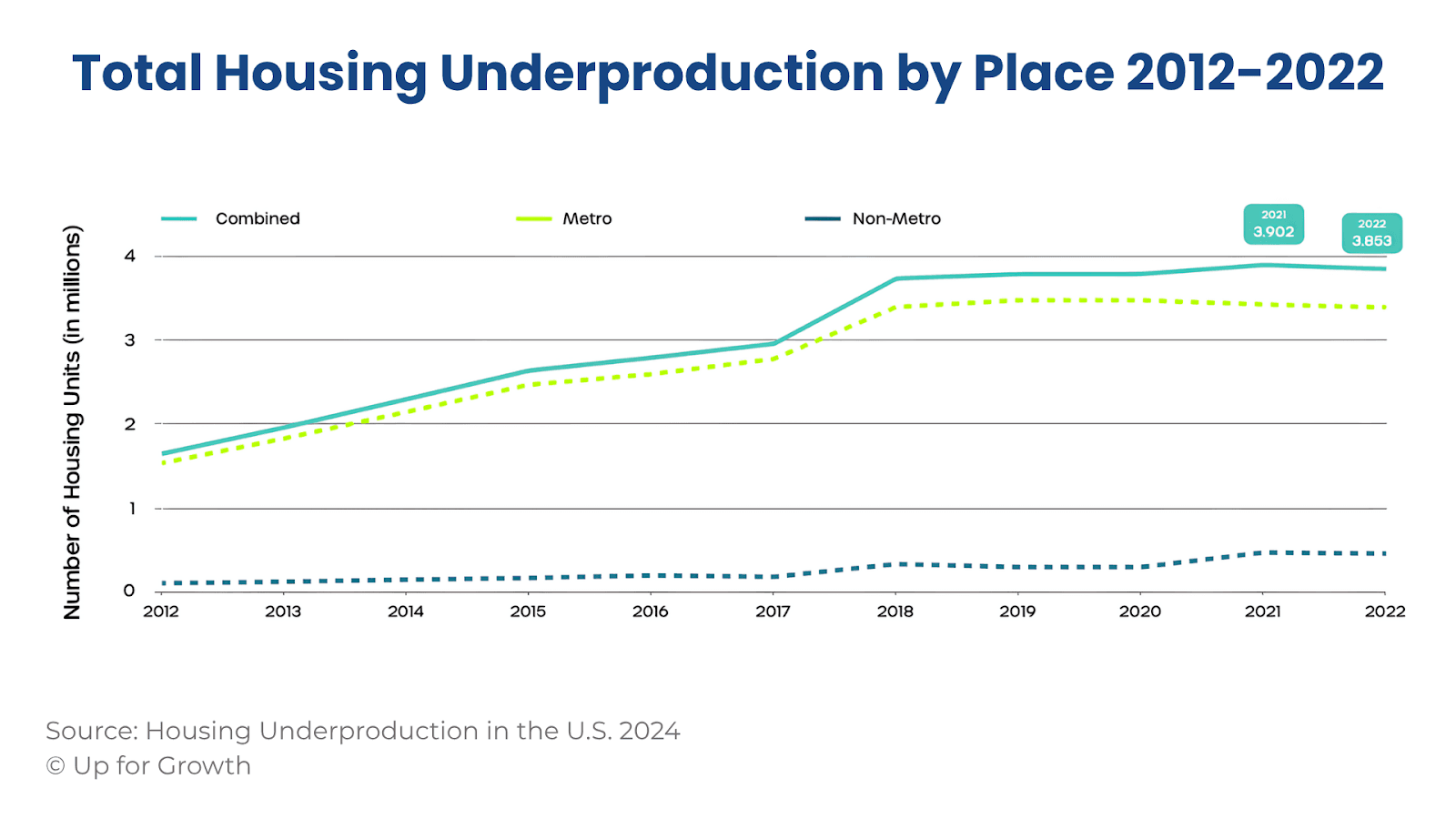

Whether you look at Freddie Mac or Up for Growth, the story does not change. The United States is short between 1.5 million to 5.5 million homes. Production continues to lag demand and new household formation, so the gap will not close by 2026. Even if interest rates continue to fall, buyers cannot buy homes that do not exist.

For property operators, this shortage means occupancy pressure may ease, but operational expectations will rise. When residents feel forced to rent, they expect service that feels worthy of that constraint.

Modular housing helps, but not enough to shift the market

Modular construction has been marketed as the answer to the housing shortage. The numbers tell a more measured story. Data from the U.S. Census Bureau and the Modular Building Institute shows that modular and manufactured housing represent 4% of new residential construction. Cost savings often fall in the 10% to 20% range. Timelines may shorten by roughly 20%, but not by the 50% often advertised.

Modular will grow, but not at a pace that solves the supply gap or transforms the economics of renting or ownership. Operators should expect incremental benefits but not a structural shift.

Interest rates will likely ease, but affordability crisis will persist

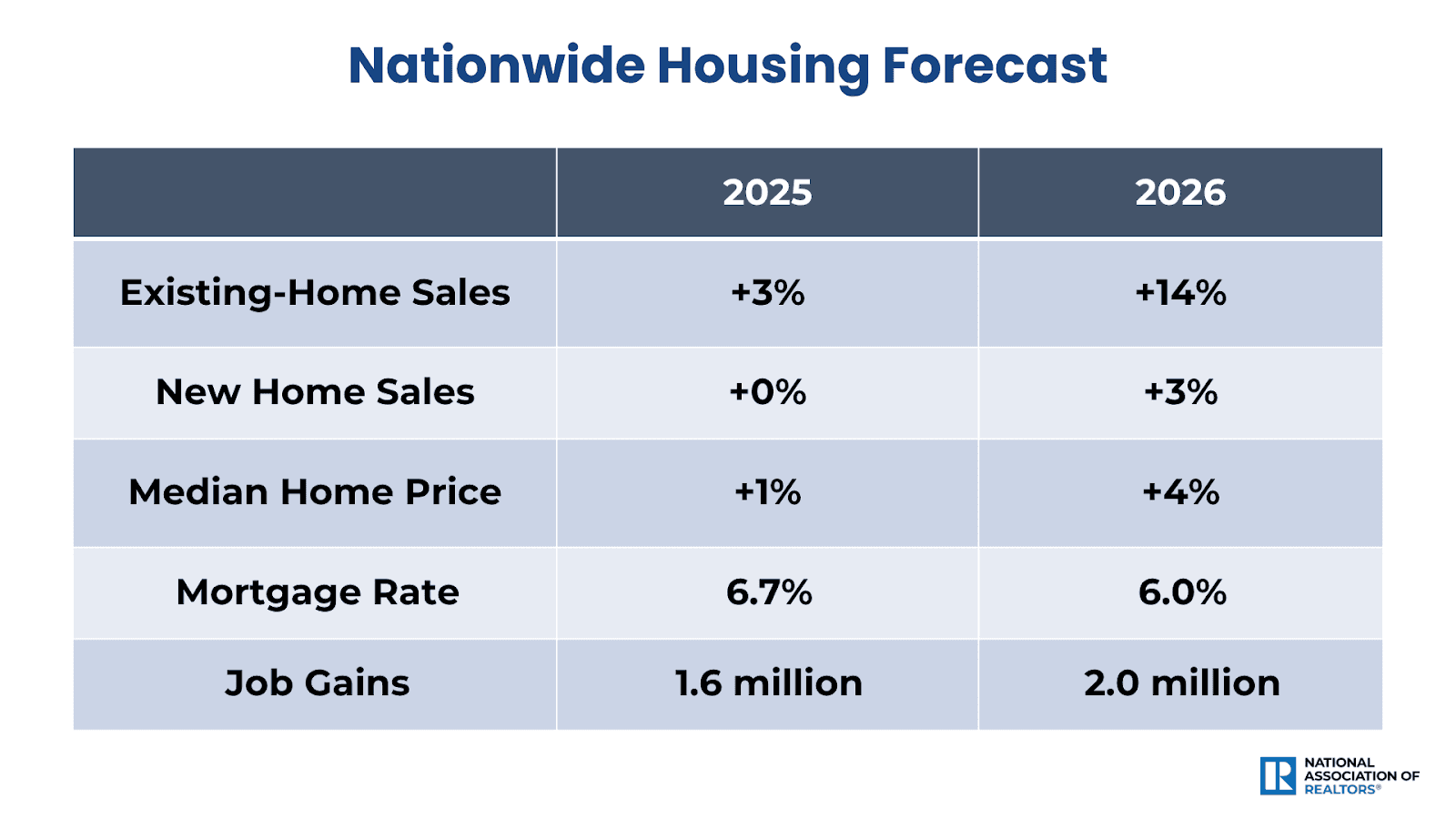

NAR’s market forecast expects a housing comeback as mortgage rates settle lower and job growth strengthens. Lower rates may spark more buyer activity, but without enough inventory, affordability will remain strained. Even NAR acknowledges that the recovery will be uneven. Lower rates alone cannot overcome a decade long supply deficit.

For large rental operators, this means some renters will leave for homeownership, but not at scale. Renewals will still depend far more on service quality than market pricing.

How Operators Should Prepare for 2026

With renters staying longer, buying later, and demanding more transparency, the next competitive frontier will not be amenities or renovation packages. It will be operational performance.

Operators should focus heavily on:

Retention-first workflows: renewal outreach that starts early, stays consistent, and removes back-and-forth

Collections discipline: predictable reminders and firm follow up that doesn’t depend on who is on shift

Maintenance clarity: fast acknowledgment, better intake details, and fewer resident “status check” calls

One voice across channels: the same answers by phone, email, SMS, and chat, with clean conversation history

Clean PMS hygiene: fewer missing fields, fewer duplicate records, and fewer “we’ll find it later” moments

Renters are not expecting perfection. They are expecting clarity and speed. With the buying path blocked for so many households, they pay closer attention to the full service. Amenities help, but the real measure is how smoothly the operation runs and how consistently the team communicates.

Where AI Fits Into a Data Driven 2026 Strategy

AI won’t fix supply or affordability. It will fix the operational gaps that get exposed when teams are stretched. In 2026, the practical use case is coverage and consistency: answering routine resident and prospect questions quickly, keeping follow up from slipping, and escalating edge cases with context so staff can make the call. That’s how operators reduce missed inquiries and protect retention without adding headcount

Domos supports this shift by acting like an additional operational layer that reduces communication load, improves accuracy, and frees staff to tackle the work that truly drives performance.

The 2026 market will reward operators who run tight systems. Residents are more informed about what good service looks like. They expect a smooth operation, not perfection but competence. In a market where homeownership is out of reach for many, the way a property is run becomes part of the value proposition. Operational clarity is not an upgrade anymore. It is the competitive edge.

Curious how automation can strengthen your operations in 2026?